Canadian study permit approvals are on track to fall by 45% in 2024, rather than the 35% planned reduction of last year’s controversial international student caps, new IRCC data analysed by ApplyBoard has revealed.

“The caps’ impact was significantly underestimated,” ApplyBoard founder Meti Basiri told The PIE News. “Rapidly introduced policy changes created confusion and had an immense impact on student sentiment and institutional operations.

“While aiming to manage student numbers, these changes failed to account for the perspectives of students, and their importance to Canada’s future economy and communities,” he continued.

The report reveals the far-reaching impact of Canada’s study permit caps, which were announced in January 2024 and followed by a tumultuous year of policy changes that expanded restrictions and set new rules for post-graduate work permit eligibility, among other changes.

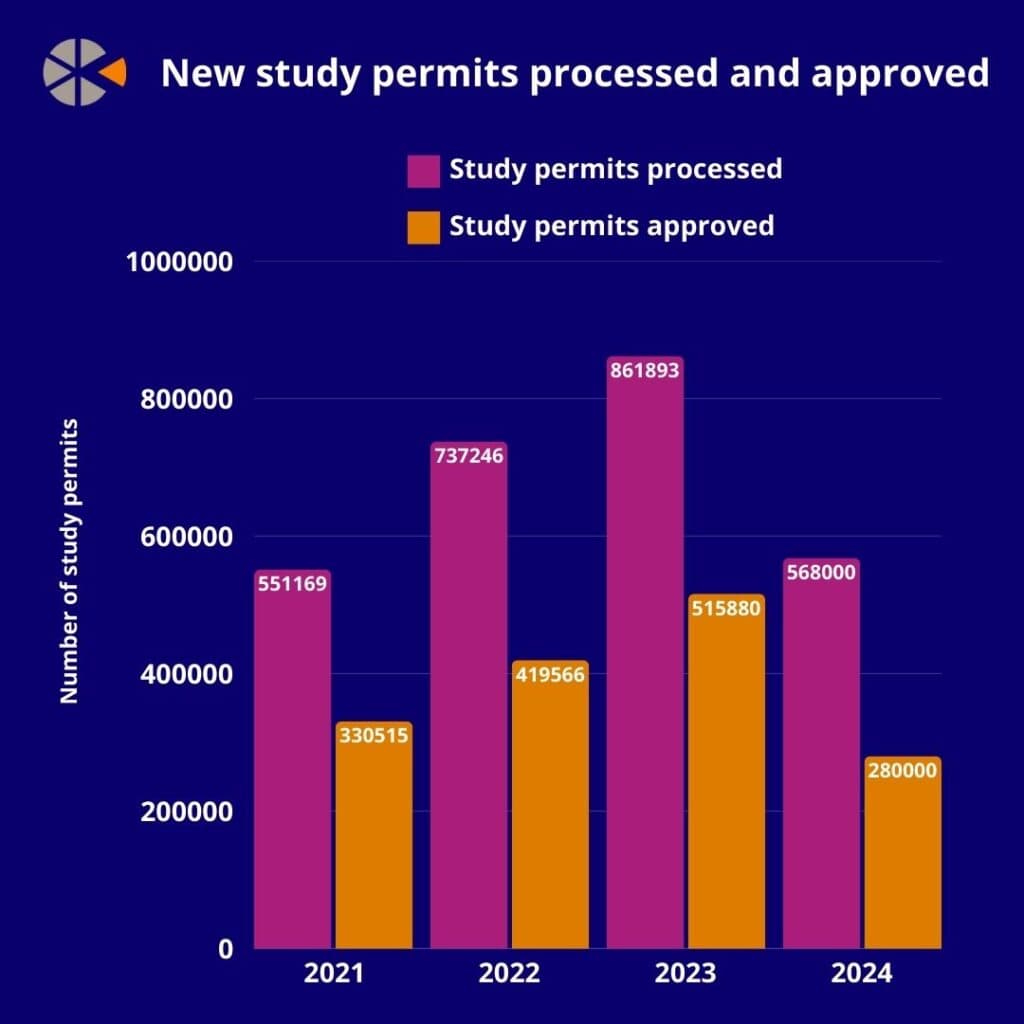

For the first 10 months of 2024, Canada’s study permit approval rate hovered just above 50%, resulting in an estimated maximum of 280,000 approvals from K-12 to postgraduate levels. This represents the lowest number of approvals in a non-pandemic year since 2019.

“Even from the early days of the caps, decreased student interest outpaced government estimates,” noted the report, with stakeholders highlighting the reputational damage to Canada as a study destination.

“Approvals for capped programs fell by 60%, but even cap-exempt programs declined by 27%. Major source countries like India, Nigeria, and Nepal saw over 50% declines, showing how policies have disrupted demand across all study levels,” said Basiri.

Following major PGWP and study permit changes announced by the IRCC in September 2024, four out of five international student counsellors surveyed by ApplyBoard agreed that Canada’s caps had made it a less desirable study destination.

Though stakeholders across Canada recognised the need to address fraud and student housing issues, many had urged the federal government to wait until the impact of the initial caps was clear before going ahead with seemingly endless policy changes.

At the CBIE conference in November 2024, immigration minister Marc Miller said he “profoundly disagreed” with the prevailing sector view that the caps and subsequent PGWP and permanent residency restrictions had been an “overcorrection”.

Post-secondary programs, which were the primary focus of the 2024 caps, were hit hardest by the restrictions, with new international enrolments at colleges estimated to have dropped by 60% as a result of the policies.

While Canada’s largest source destinations saw major declines, the caps were not felt evenly across sending countries. Senegal, Guinea and Vietnam maintained year-over-year growth, signalling potential sources of diversity for Canada’s cap era.

The report also highlighted Ghana’s potential as a source destination, where approval ratings – though declining from last year – remain 175% higher than figures from 2022.

Rapidly introduced policy changes created confusion and had an immense impact on student sentiment

Meti Basiri, ApplyBoard

The significant drop in study permit approvals was felt across all provinces, but Ontario – which accounted for over half of all study permit approvals in 2023 – and Nova Scotia have seen the largest impact, falling by 55% and 54.5% respectively.

Notably, the number of study permits processed by the IRCC dropped by a projected 35% in 2024, in line with the government’s targets, but approval rates have not kept pace.

When setting last year’s targets, minister Miller only had the power to limit the number of applications processed by the IRCC, not the number of study permits that are approved.

The initial target of 360,000 approved study permits was based on an estimated approval rate of 60%, resulting in a 605,000 cap on the number of applications processed.

Following new policies such as the inclusion of postgraduate programs in the 2025 cap, Basiri said he anticipated that study permit approvals would remain below pre-cap levels.

“While overall student numbers may align with IRCC’s targets, the broader impact on institutional readiness and Canada’s reputation will be key areas to watch in 2025,” he added.